The cryptocurrency market is known for its volatility, which can both lure and scare investors. On the one hand, market volatility can create great opportunities for profit. On the other hand, it can also lead to significant losses if appropriate measures are not taken. Using software from a cryptocurrency exchange software development company, you can get a good profit, but you need to take into account many nuances so as not to lose too much.

Basic rules of cryptocurrency trading

Cryptocurrency trading can be profitable, but there are many risks to consider. The cryptocurrency exchange development has its own features, which are imposed on users in the form of fees. Therefore, it is necessary not only to choose good software but also to pay attention to the following recommendations:

- Do your research. Before investing in any cryptocurrency, it is important to do a thorough research on the project and the team behind it. Understand the technology behind cryptocurrency and its potential uses. Don’t invest in something you don’t understand.

- Manage risks. Don’t trade with a lot of money you can’t afford. Use the tools available to limit your losses and diversify your investments so you don’t depend on a single cryptocurrency.

- Have a long-term perspective. The cryptocurrency market is still in its early stages of development, so it can be difficult to expect short-term profits. Take a long-term view and you’ll be better prepared for the inevitable volatility.

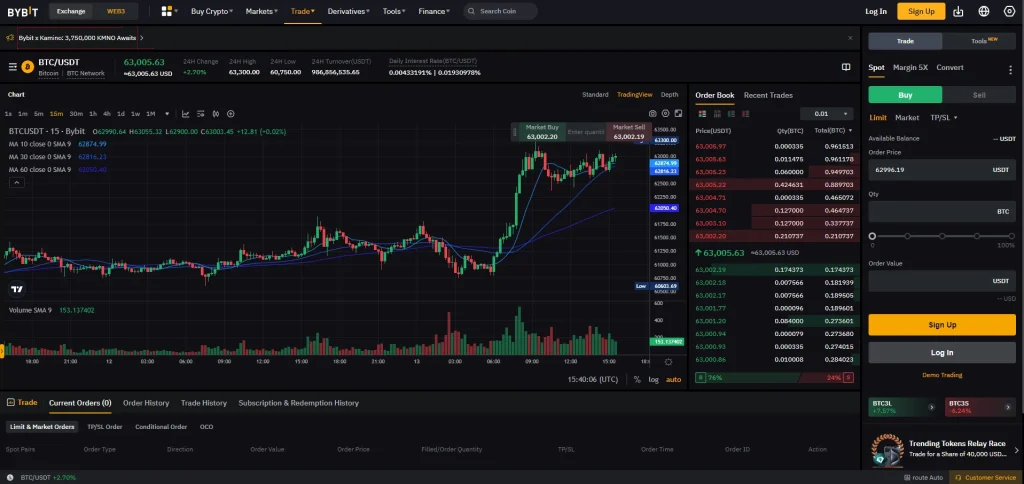

- Choose a reliable exchange. It is important to choose a reliable and safe crypto exchange software. Make sure the exchange has a good reputation and offers a wide range of features.

- Safely store your cryptocurrency. It is important to keep your cryptocurrency safe. You can store your cryptocurrency on an exchange or in your own crypto wallet.

- Be careful of scammers. Unfortunately, there are many scammers in the cryptocurrency world. Be careful what you invest in and who you share your personal information with.

- Keep learning. The cryptocurrency market is constantly evolving, so it is important to constantly learn and stay up to date with the latest news and events.

By following these basic rules, you can increase your chances of success in cryptocurrency trading. It is worth following the rules of responsibility and doing everything possible to minimize the risks when trading cryptocurrency.

Proven trading strategies

There are many trading strategies in the cryptocurrency market, each of which has its pros and cons. Among the most effective options suitable for beginners, it is worth paying attention to the following:

- Long-term investment. This is the easiest and least risky cryptocurrency trading strategy using crypto exchange software. It consists in buying a cryptocurrency and holding it for a long period of time, hoping that its value will increase. The strategy is well suited for investors who have a long-term planning horizon and are willing to tolerate market volatility.

- Trading on a daily range. This approach involves buying and selling cryptocurrency within a day to take advantage of small price movements. It is more profitable than long-term investing, but also requires more time and effort.

- Scalping. This is a riskier strategy that involves buying and selling cryptocurrency for short periods of time to make a small profit. This approach requires a very quick reaction and a deep understanding of technical analysis.

- Arbitration. This strategy consists of buying cryptocurrency on one exchange and selling it on another at a higher price. This approach can be profitable, but it requires careful research and quick execution.

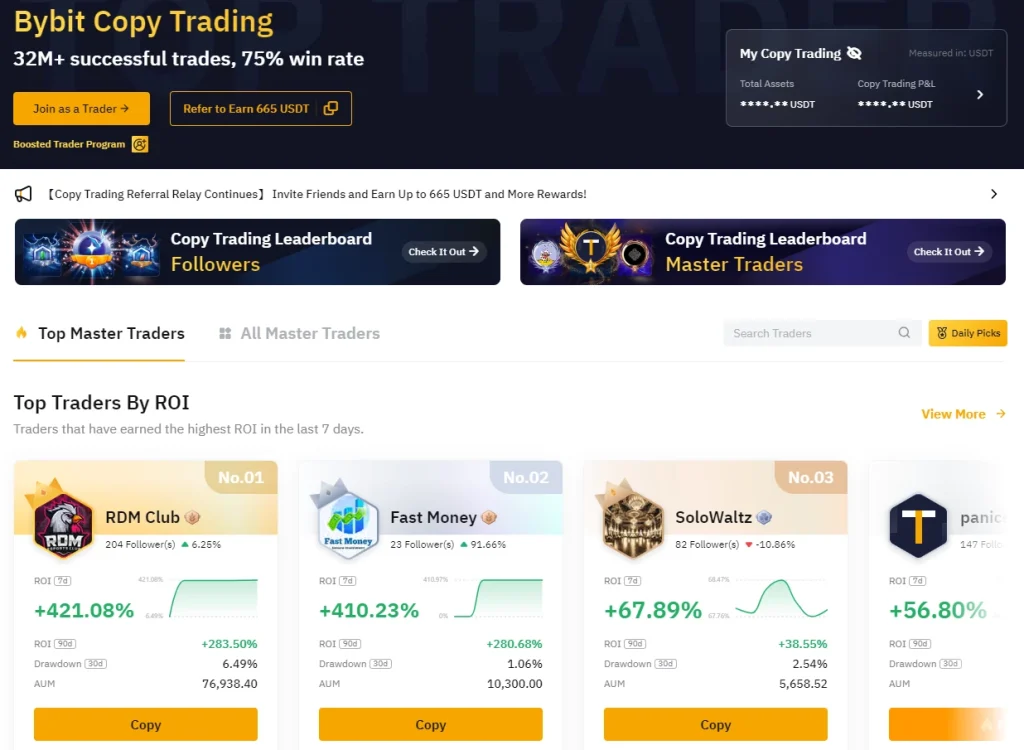

- Copy trade. This strategy consists in automatically copying the trades of other successful traders. It can be a good option for beginners who do not have experience in cryptocurrency trading.

It’s important to note that none of these strategies guarantee success. Cryptocurrency trading is always risky and you can lose all your investment. Before using any of these strategies, it is important to do thorough research and understand the risks involved. You should also only use money that you can afford to lose.

What factors to consider when trading in a volatile market?

When trading cryptocurrency, it is worth considering many factors that affect the efficiency of earning with the help of crypto exchange software. Pay attention to the following points:

- Volatility. The cryptocurrency market is highly volatile, which means prices can change quickly. It’s risky, but it also creates opportunities for profit.

- Trading volume. This is the amount of cryptocurrency that is bought and sold on the exchange. A high trading volume usually indicates a more liquid market, making it easier to buy and sell cryptocurrency.

- News and events. They can have a significant impact on prices. It’s important to keep up with the latest developments in cryptocurrency trading to make informed trading decisions.

- Technical analysis. It is a method of predicting future price movements based on past price and trading volume data. Technical analysis is a useful tool for identifying trading opportunities in a volatile market.

- Fundamental analysis. It is a method of estimating the value of a cryptocurrency based on its underlying values such as technology, team, and potential uses. It is useful for determining the long-term prospects of a cryptocurrency.

- Risk management. It is important to use risk management techniques to protect your investments. This includes using stop-loss orders, diversifying your investments and managing your position size.

- Research. Before investing in any cryptocurrency, it is important to do a thorough research on the project and the team behind it. Understand the technology behind cryptocurrency and its potential uses.

Cryptocurrency trading is a complex process that requires consideration of many subtleties. It is important to approach this issue responsibly and carefully weigh all possible risks.

What else to pay attention to?

Additional nuances should be taken into account when trading cryptocurrency. This is especially important in unstable times. Pay attention to the following tips:

- Liquidity. Make sure the cryptocurrency you are trading is liquid. This means that you should be able to easily buy and sell it without significantly affecting the price.

- Commissions. Before you start trading, compare the commissions of different exchanges. Some exchanges charge higher fees than others, which can affect your profitability.

- Security. Make sure the exchange you use is safe and has a good reputation. You should also take steps to protect your cryptocurrency from hackers and scammers.

- Regulation. It is important to know the regulations governing the cryptocurrency market. This significantly affects the choice of activity vector.

- Tax burden. It is also necessary to familiarize yourself with the tax regulations in order to correctly pay tax on cryptocurrency trading.

Trading cryptocurrency in a volatile market is quite difficult. It is necessary to take into account many subtleties in this process in order not to lose too much and really earn.