Over the last few years, Nigeria has seen a massive rise in the use of cryptocurrencies. From young professionals in Lagos running online businesses, to students in Enugu paying for courses abroad, to traders in Kano sending funds to suppliers overseas — more and more people are depending on digital currencies to support everyday financial activities. And while Bitcoin and Ethereum are the two names that often get the most attention, something interesting has happened: stablecoins like USDT are slowly becoming the most practical and widely used digital currencies in Nigeria.

To understand why this shift is happening, it helps to look at the economic environment in Nigeria today. Currency instability, rising inflation, the cost of international transactions, and limited access to global payment systems all play a major role. People are not just investing in crypto for profit anymore. They are using it as a working currency — a tool they depend on to store value, move money across borders, pay for digital services, and support daily financial life.

Stablecoins, especially USDT, have become the digital financial backbone for a large number of Nigerians.

This article explains in simple language why USDT matters, how Nigerians are using it, and why it plays such a big role in the financial lives of many individuals and businesses today.

Understanding Stablecoins in Simple Terms

Let’s break it down clearly:

- Bitcoin and Ethereum prices go up and down daily.

- Sometimes they rise fast, sometimes they fall fast.

- This makes them risky to use for everyday spending.

Stablecoins, on the other hand, are cryptocurrencies that are tied to real-world currency values, like the US dollar. So when 1 USDT is equal to $1, it stays close to that value most of the time.

This stability makes USDT useful for:

- Saving money without worrying about big price drops

- Doing business transactions

- Paying people in different countries

- Keeping account balances in a protected value

In other words, USDT is digital money that doesn’t shake.

Why USDT Is Becoming Very Popular in Nigeria

There are several reasons why USDT use is rising fast:

1. Inflation and Currency Instability

The naira has faced constant devaluation. Prices of food, electronics, rent, business supplies — almost everything — keeps going up. Many people feel their money loses value faster than they can use it.

USDT allows people to store value more safely.

₦100,000 kept in naira may drop in value next month, but ₦100,000 converted to the dollar value in USDT tends to hold steady.

2. Easy Cross-Border Transactions

People now:

- Pay freelancers abroad

- Buy software, apps, tools, and courses online

- Pay overseas suppliers for small business goods

Banks make international transfers:

- Slow

- Expensive

- Complicated

USDT solves this with fast and cheap transfers.

3. It’s Easier to Use Than Many Banking Systems

Many Nigerians understand crypto better than old banking paperwork.

Wallet apps are simple:

- Send money like sending a text message.

- Receive money instantly.

4. Growing Digital Work Economy

There are thousands of Nigerians working online:

- Graphic designers

- Programmers

- Writers

- Video editors

- Social media managers

Many global clients pay in USDT because it’s stable and fast.

How Nigerians Use USDT in Daily Life

USDT is no longer “just for crypto traders.”

People are using it for practical, everyday reasons:

- Saving: To avoid naira losing value month-to-month.

- Business Deals: Paying suppliers directly without dollar scarcity issues.

- Freelancer Payments: Getting paid faster than through banks.

- Family Transfers: Sending money to relatives within and outside Nigeria.

- Online Purchases: Paying for software, subscriptions, ads, and services.

It has become a digital wallet version of stable money.

Understanding Conversion: From USDT to Local Money

Many people receive USDT but eventually need cash to live daily life.

At some point, you need to convert Usdt to naira, especially for:

- Rent

- Food

- Transport

- Utility bills

- Business operations

Different platforms and exchanges make this conversion possible.

The main things to consider when choosing one are:

- Speed (how fast you get paid)

- Rate (how much naira you get per dollar)

- Security (avoiding scams)

- Ease of use (simple app or platform process)

Always use platforms with:

- Verified vendors

- Customer support

- Clear transaction steps

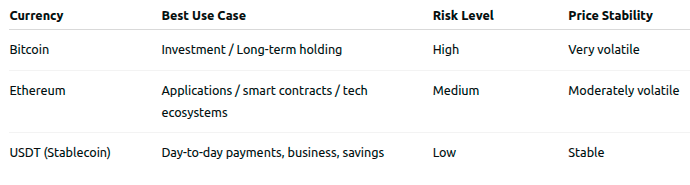

Comparing Stablecoins with Other Cryptocurrencies

This helps explain the role of USDT more clearly:

Sometimes, people need to switch assets depending on their goals.

For example, when converting Ethereum to naira, users want a one-time transaction and stable payout, so they convert from ETH → USDT → naira.

USDT often becomes the bridge between different types of crypto and real-world spending.

How Nigerians Move From Cash to Crypto

A lot of people begin by buying Bitcoin or USDT using their naira wallets.

Others earn crypto online and need to convert it back to cash later.

Some individuals search for naira to bitcoin exchange platforms, especially when they want to switch between local currency and crypto quickly. This shows how everyday Nigerians are now comfortable using crypto systems as part of normal financial life.

Where Nigerians Trade Safely

There are now many platforms offering crypto services in Nigeria.

Some are international. Some are local. Some operate as mobile apps that allow instant crypto exchange.

These platforms are generally known as Nigerian crypto exchanges and they play an important role in:

- Setting exchange rates

- Providing secure transactions

- Protecting users from fraud

- Offering easy bank withdrawals

But users must always check reputation, read reviews, and avoid unknown or unverified dealers.

Using Binance and Other Crypto Platforms

One common method people use to convert or trade is through Binance.

But the most important part is understanding how conversions work — especially when trying to confirm Binance usdt to naira transfers.

Users should:

- Always confirm wallet addresses carefully

- Avoid sharing private keys

- Never trust “proof of payment” screenshots

- Use escrow when possible

Crypto is extremely secure — but human mistakes or scams can cause loss.

Safety rule:

If anything looks rushed, unclear, or suspicious — stop.

Challenges Nigerians Face in the Crypto Space

Even though stablecoins have made financial life easier, there are challenges:

1. Scams and Fake Traders

Social media is full of accounts pretending to buy and sell crypto.

If someone offers a “too high” rate — it is usually a trap.

2. Lack of Understanding

Some new users don’t know how wallets, transfers, or fees work.

People need to learn the basics before sending large amounts.

3. Unstable Internet Connection

Crypto depends on internet access.

Poor connectivity can delay or confuse transactions.

4. Emotional Decision-Making

People sometimes panic when prices move or when traders pressure them.

Patience is key.

The Future of Stablecoins in Nigeria

Nigeria is moving into a fully digital financial era.

- Young people are building careers online.

- Small businesses are connecting to global suppliers.

- Individuals are learning how to store value intelligently.

- Digital payments are becoming normal and expected.

Stablecoins like USDT are not just a trend.

They are part of the new financial system emerging in Nigeria.

As more people:

- Accept digital payments

- Run remote businesses

- Send and receive international funds

- Save against inflation

USDT will continue to grow in importance.

Final Thoughts

USDT has become much more than a digital currency in Nigeria.

It is a financial safety tool, a business tool, a savings method, and a payment gateway — all at the same time.

In a fast-changing economy, Nigerians are choosing tools that give:

- More control

- More protection

- More flexibility

Stablecoins — especially USDT — provide exactly that.